Project Overview

This project outlines the architecture for a comprehensive, standalone Decentralized Exchange (DEX). Unlike an aggregator that compares other platforms, this system is the core trading engine itself. It enables users to trade, swap, and provide liquidity directly on-chain through a suite of robust smart contracts. It features a high-performance matching engine, automated market making (AMM) capabilities, and deep liquidity pools to ensure efficient, secure, and decentralized peer-to-peer transactions.

Engineered for security and performance, the platform integrates essential DeFi primitives, including decentralized oracles for accurate pricing, yield farming mechanisms to incentivize liquidity, and cross-chain compatibility to support a multi-chain ecosystem. The result is a foundational, secure, and scalable DEX built to empower users with full control over their assets.

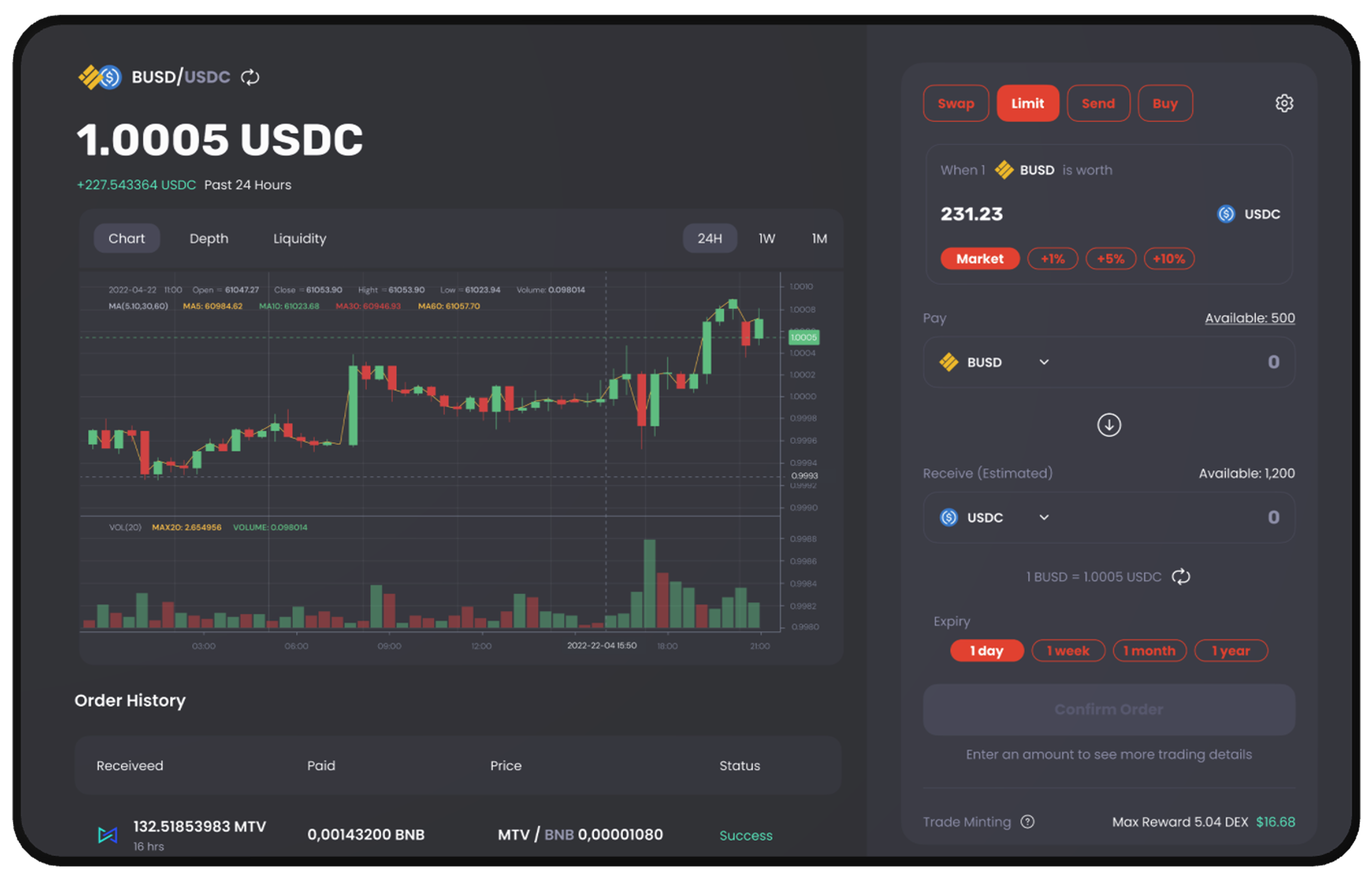

Web Application Showcase

Key Features

- Web3 Integration: Secure user wallet integration using cryptographic techniques and key pair management.

- Smart Contract Integration/Audits: Integrate and deploy audited smart contracts for automated transaction execution.

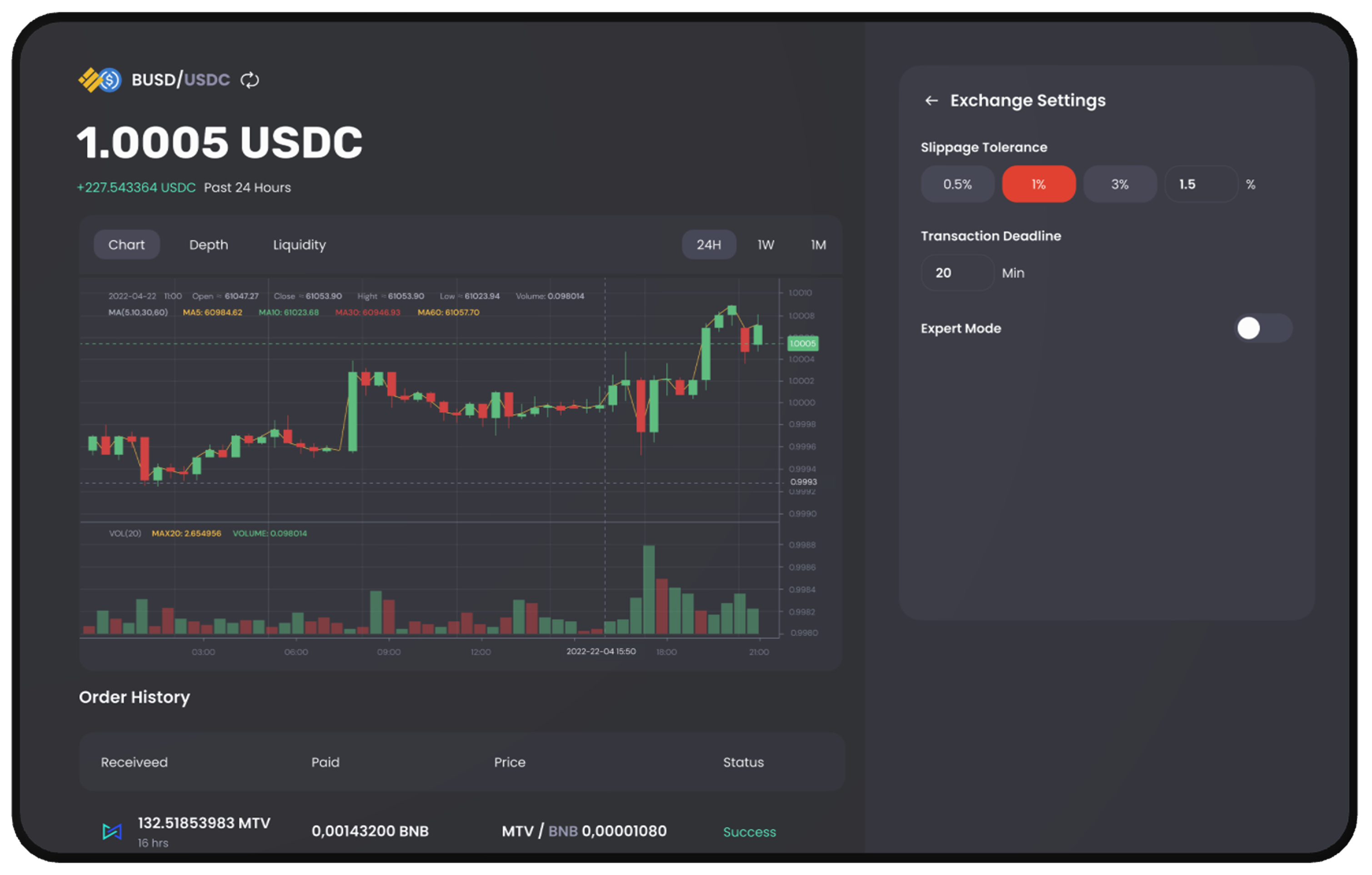

- Order Book: Build and maintain an order book with real-time order information.

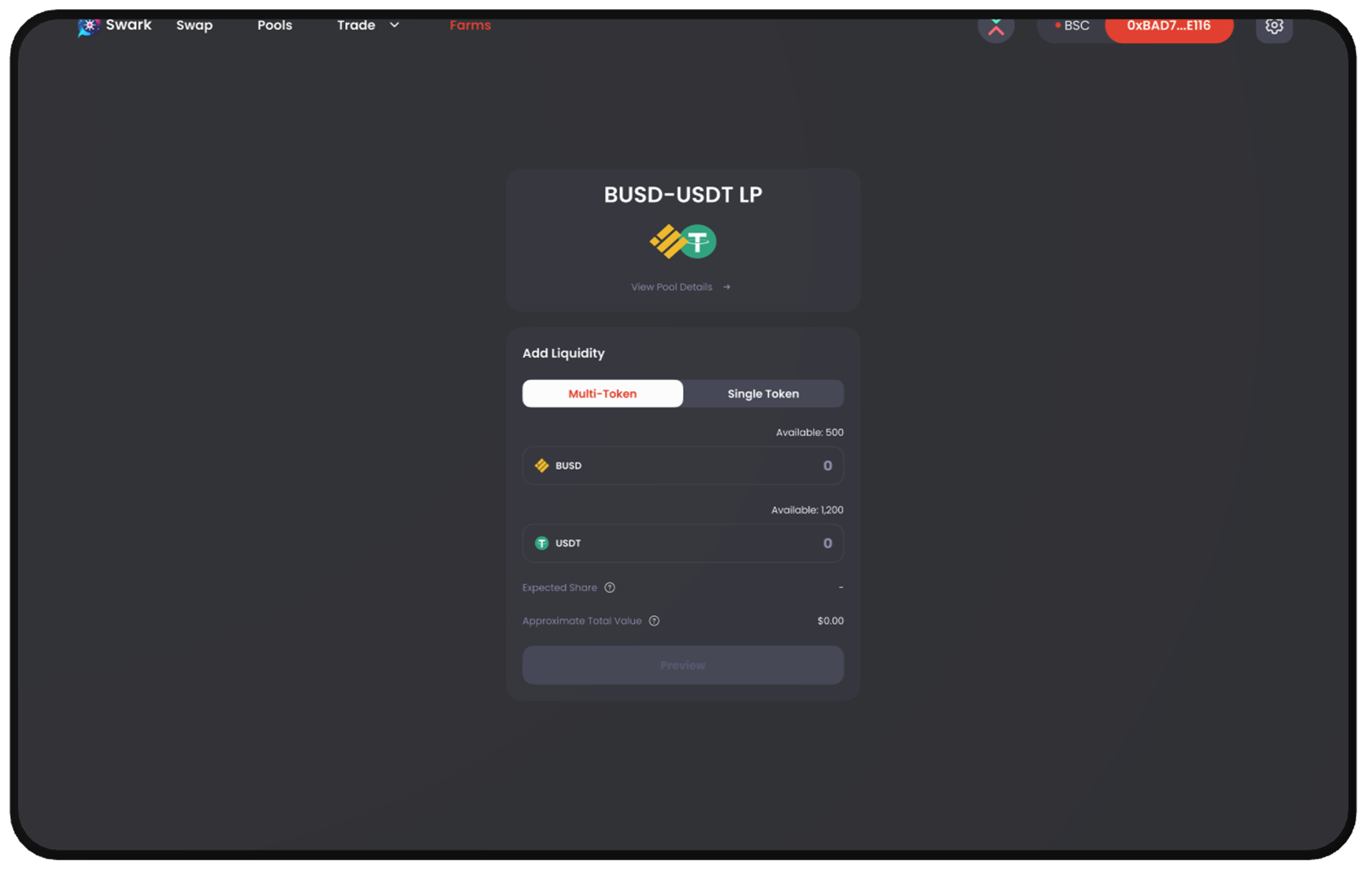

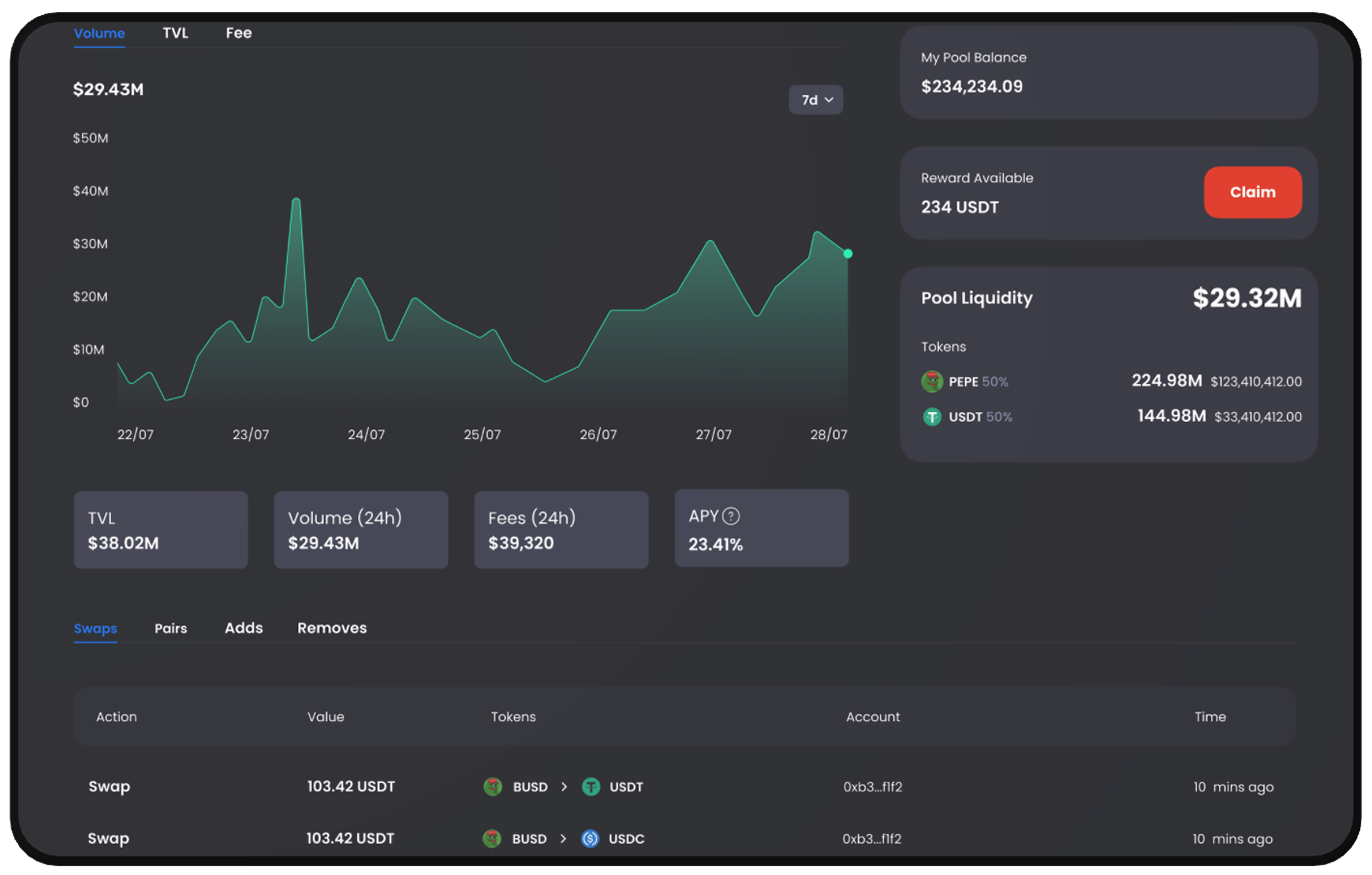

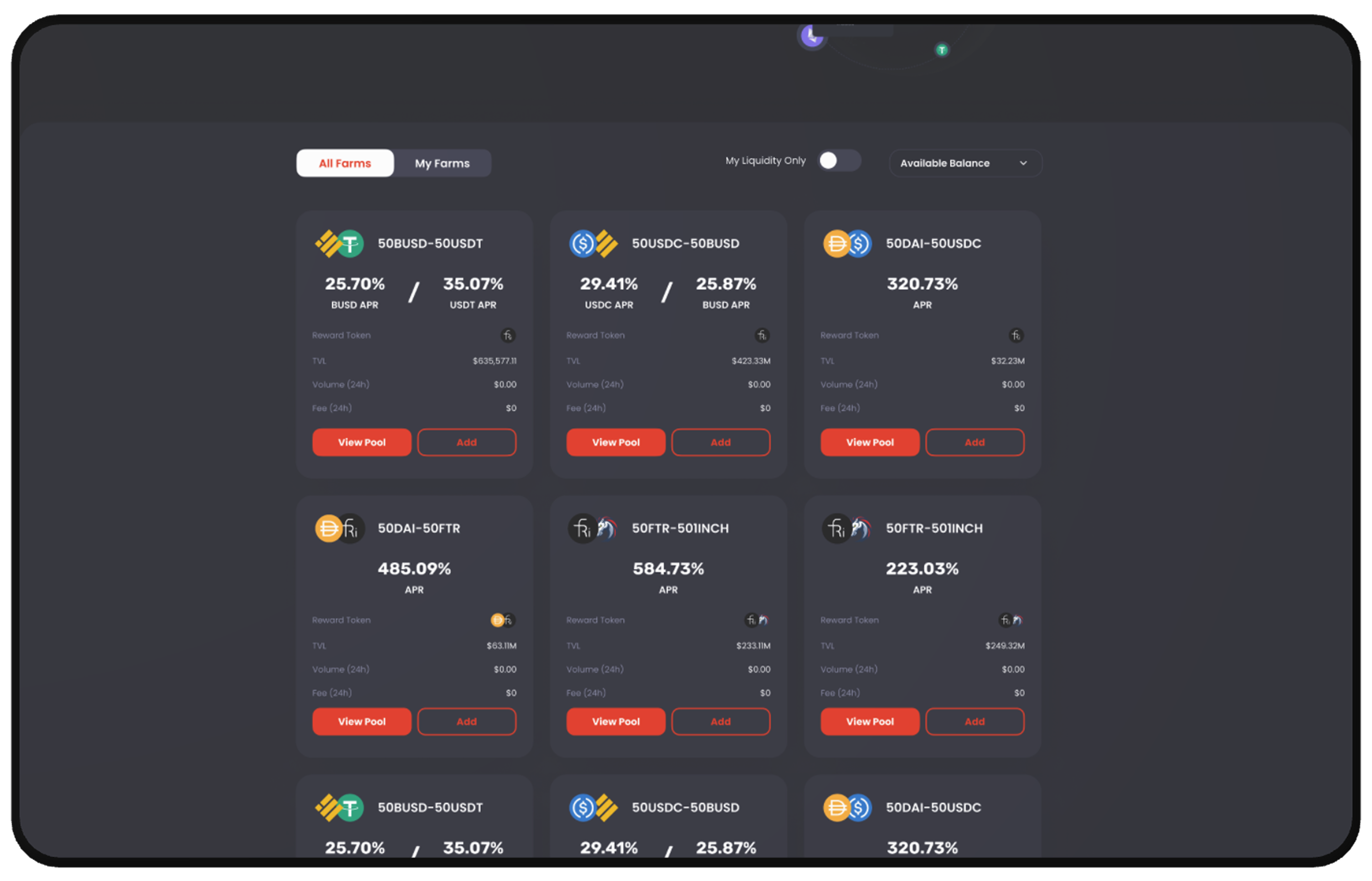

- Liquidity Pools: Integrate with decentralized liquidity pools using smart contracts.

- Token Swap: Ensure verifiable token exchanges through blockchain transactions.

- Multi-Currency Support: Support multi-currency transactions and automatic conversion using oracles.

- Cross-Chain Compatibility: Facilitate transactions between different blockchains using cross-chain protocols.

- Security Measures: Implement SSL/TLS, 2FA, DNSSEC, Anti-DDoS, Multisig Vaults, and more.

- User Interface (UI/UX): Design a clear and intuitive user experience for the decentralized exchange.

- Decentralized Governance: Enable user participation in on-chain decision-making processes.

- Automated Market Making (AMM): Optimize trading processes and enhance liquidity through dynamic price adjustments.

- Liquidity Providing: Encourage users to provide liquidity by rewarding them with real-yield APR.

- Yield Farming: Allow users to earn profits by participating in liquidity farms.

- Limit Orders: Allow users to buy or sell at a specific price or better.

- Liquidity Aggregation: Integrate multiple liquidity sources to optimize prices and flexibility.

- Token Swaps Across Chains: Allow users to trade tokens issued on different blockchains.

- Decentralized Oracles: Enable the DEX to query the current, real-world price of an asset.

- Margin Trading: Allow users to trade with borrowed funds.

- Extended Trading View: Provide advanced charting for users to analyze market trends.

- Matching Engine: Power the order-matching process, ensuring efficient and timely trade executions.

Solutions

- Developed and audited secure smart contracts for core functionalities like AMM, liquidity pools, and the matching engine.

- Engineered a high-performance order book system for real-time trade execution and limit orders.

- Implemented comprehensive, multi-layered security measures, including multi-sig vaults, 2FA, and application firewalls, to protect user assets.

- Designed a flexible, modular architecture to support multi-currency, cross-chain compatibility, and future decentralized governance models.